BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

FY 2025 (July 1, 2024 – June 30, 2025) was a record year for BullionStar. Total revenue reached SGD 761.1 million, an 80% increase compared to FY 2024.

Key highlights

- Revenue: SGD 761.1 million (+79.7% year on year)

- Buy orders: 55,686 (+44.6%)

- Average order size: SGD 13,873 (+26.2%); median order size: SGD 1,469 (+46.7%)

- Peak buying months: April 2025 (7,659 buy orders) and June 2025 (5,738 buy orders)

- Website visits: 5,283,570 (+42.7%)

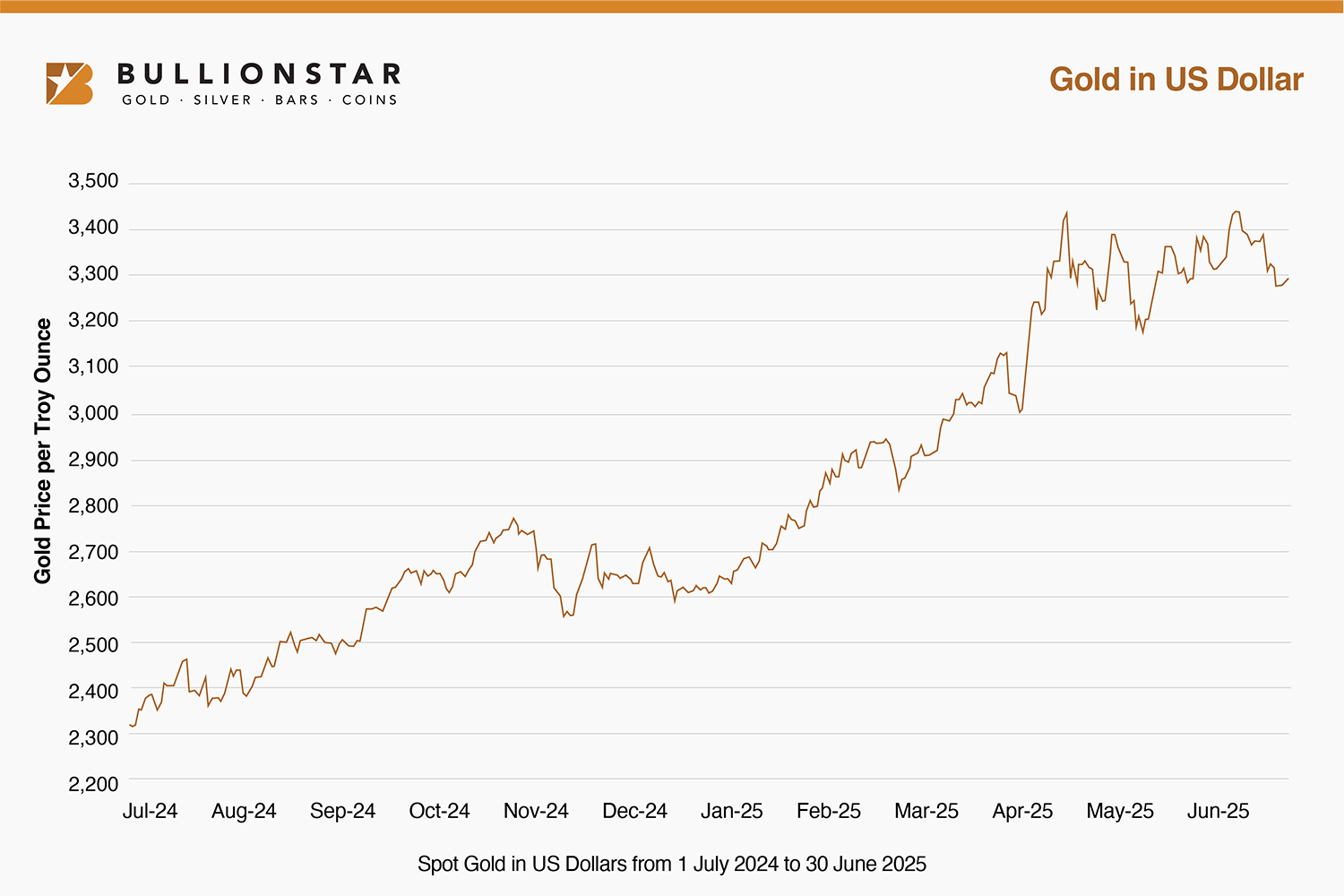

Precious Metal Price Trends

Gold Price

- Spot Gold: Closed FY 2025 at USD 3,289/oz (June 30, 2025), up from USD 2,329/oz on July 1, 2024 – a 41.3% gain.

- The last fiscal year experienced a tremendous rally in gold prices, with gold hitting 44 new all-time highs.

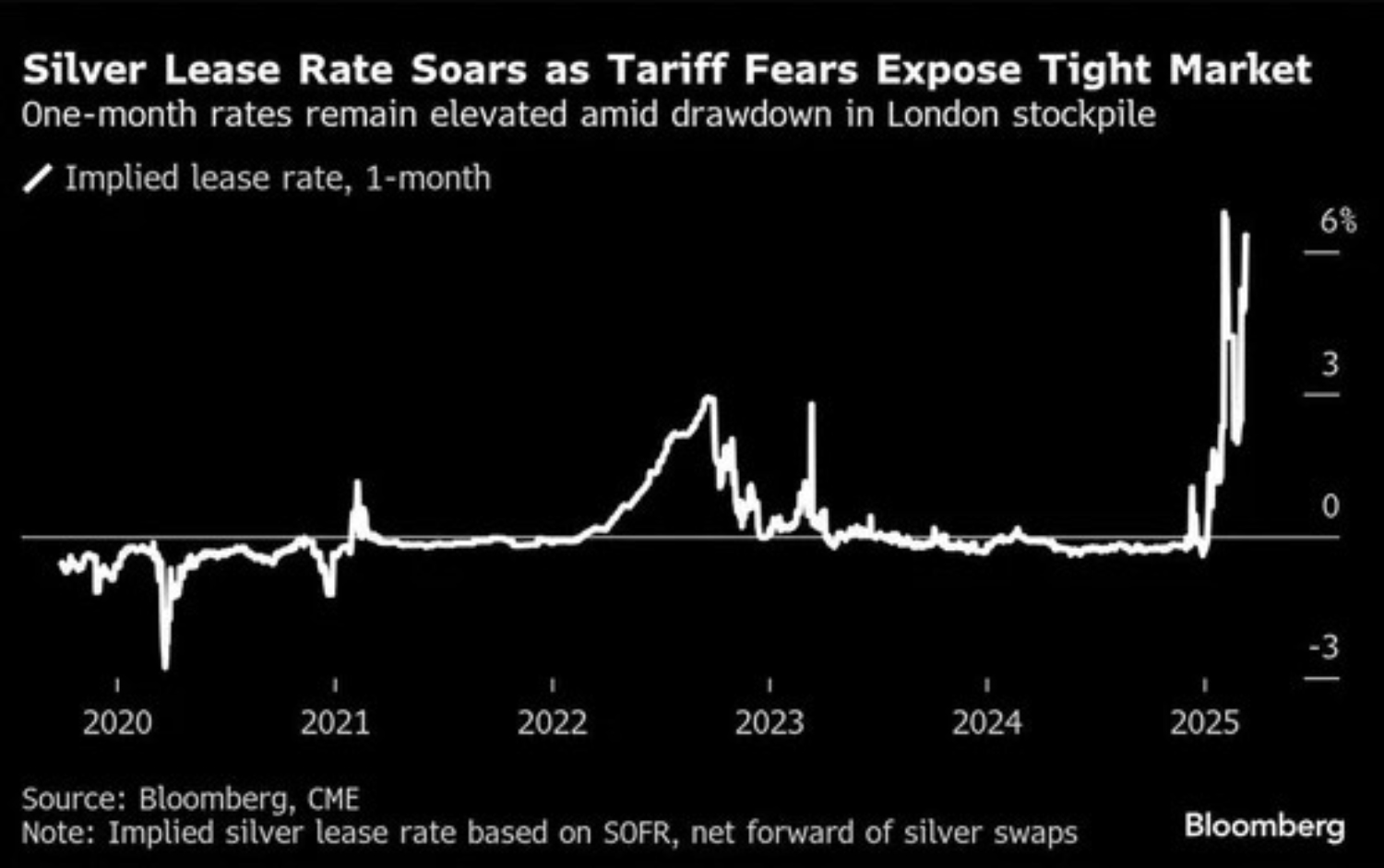

Silver Price

- Spot Silver: Closed FY 2025 at USD 35.97/oz (June 30, 2025), up from USD 29.28/oz on July 1, 2024 – a 22.8% gain.

- In June 2025, silver surged above USD 35/oz and broke through a 13-year resistance zone.

- Silver rallied by 9% in the month of June, fuelled by insatiable investor demand and supply shortages.

Record Demand at BullionStar as Customers Flocked to Safe-Haven Assets

In April 2025, demand for precious metals surged following Trump’s tariff announcements. Revenue in April more than doubled compared to the prior year and set a record at BullionStar.

Significant customer demand led to a buy-to-sell ratio above 2:1 for the month – meaning customers were buying more than double the value of bullion compared to what they were selling. Our Bullion Center in Singapore experienced customers queuing outside, eager to load up on physical precious metals.

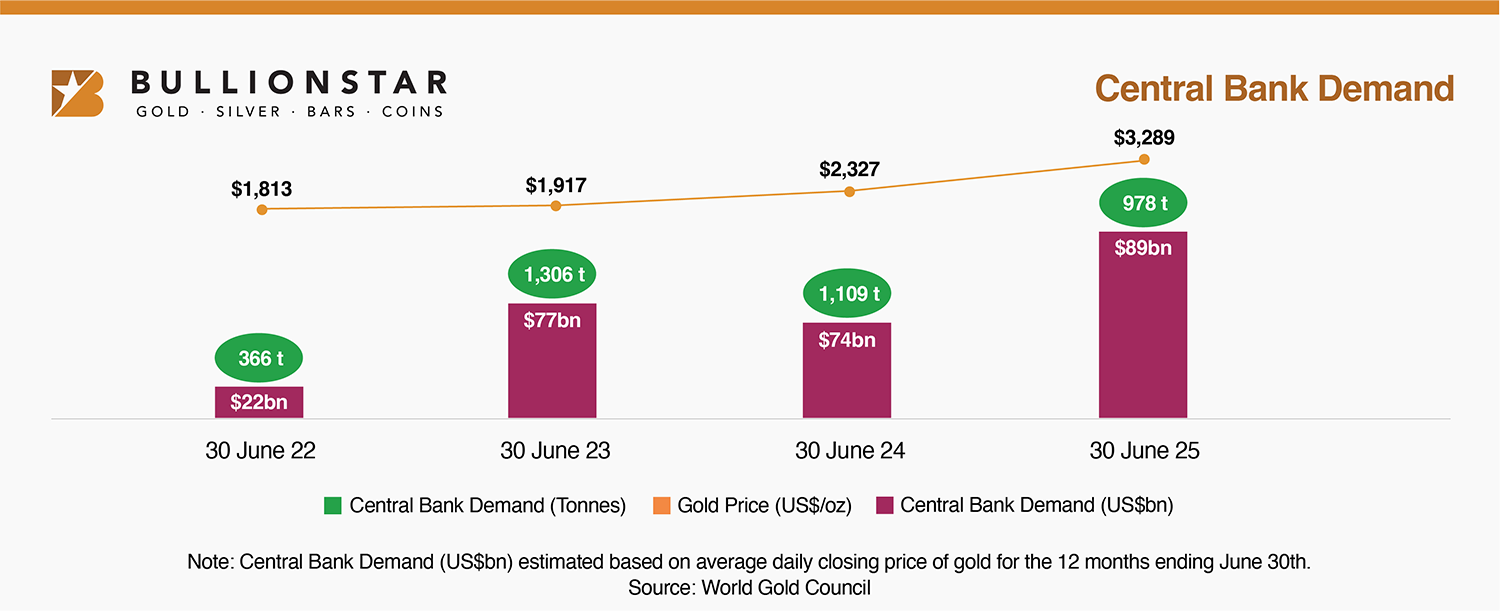

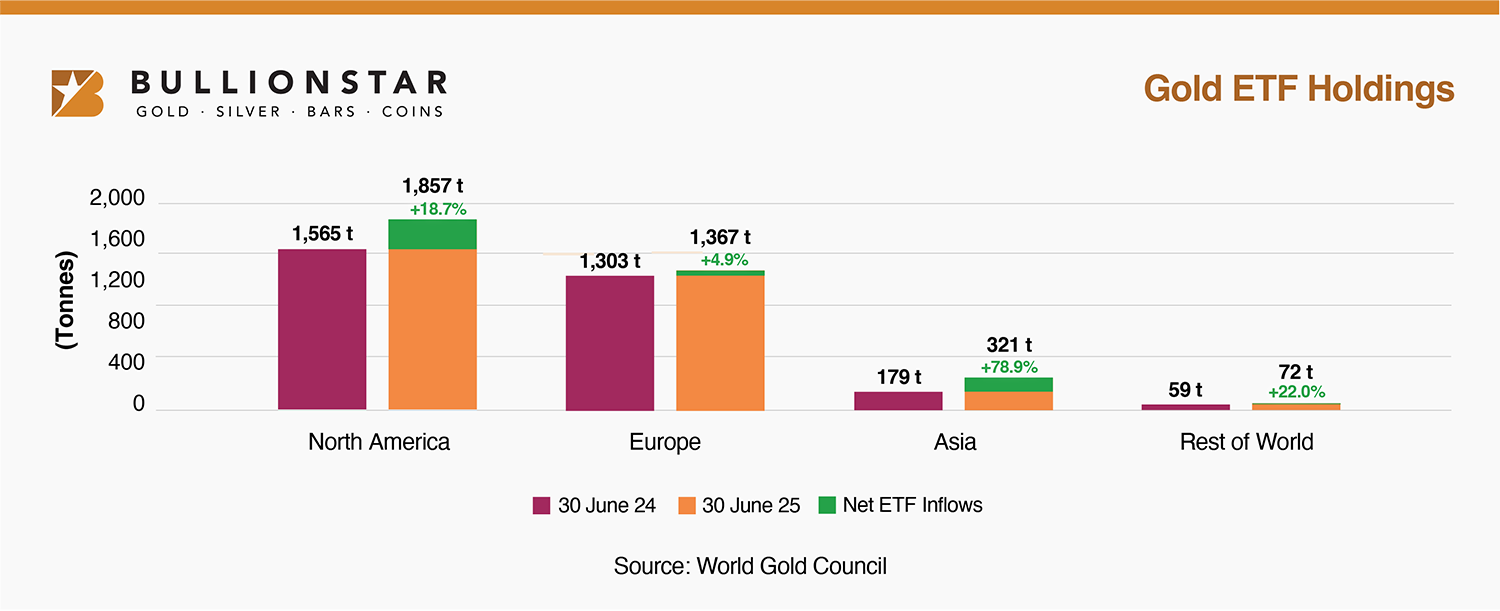

Precious Metals Rally on the Back of Trump’s Liberation Day, Central Bank Demand, and ETF Flows

On April 2, 2025, United States President Donald Trump announced a broad range of tariffs to address the trade deficit and rising debt levels. The announcement sent shockwaves through global markets, with the S&P 500 dropping 12% in the week following the announcement. Tariff uncertainty fuelled demand for precious metals as investors sought safe-haven assets and tried to manage exposure to the US dollar.

In FY 2025, central banks continued to accumulate gold at a rapid pace. The estimated US dollar value of gold purchased by central banks increased approximately 20% in the year ending June 30, 2025. This increase builds on near-record purchases in the prior two years. However, due to the higher gold prices, the tonnes purchased declined compared to FY 2023 and FY 2024. Despite the record-high gold prices, central bank demand remains robust.

Gold ETFs experienced an acceleration of inflows in FY 2025. Gold ETF holdings increased by over 500 tonnes, representing a 16% increase in the year ending June 30, 2025. North America and Asia were the largest contributors, increasing by ~290 tonnes (+19%) and ~140 tonnes (+79%), respectively.

In early 2025, the market experienced significant physical supply shortages, especially for silver. The implied 1-month silver lease rate in Q1 and Q2 2025 spiked to 4–6% compared to its typical rate of a few basis points.

Which Months Saw the Most Buying Activity at BullionStar?

April 2025 and June 2025 experienced a surge in activity.

April 2025:

7,659 buy orders, driven by the announcement of Trump’s liberation day tariffs, which accelerated investor demand for physical precious metals.

June 2025:

5,738 buy orders were placed, spurred by a structural breakout of silver prices above USD 35/oz, a 13-year resistance zone.

BullionStar Financials FY 2025 – Year in Review – Sales

Total Sales Revenue: SGD 761.1 million

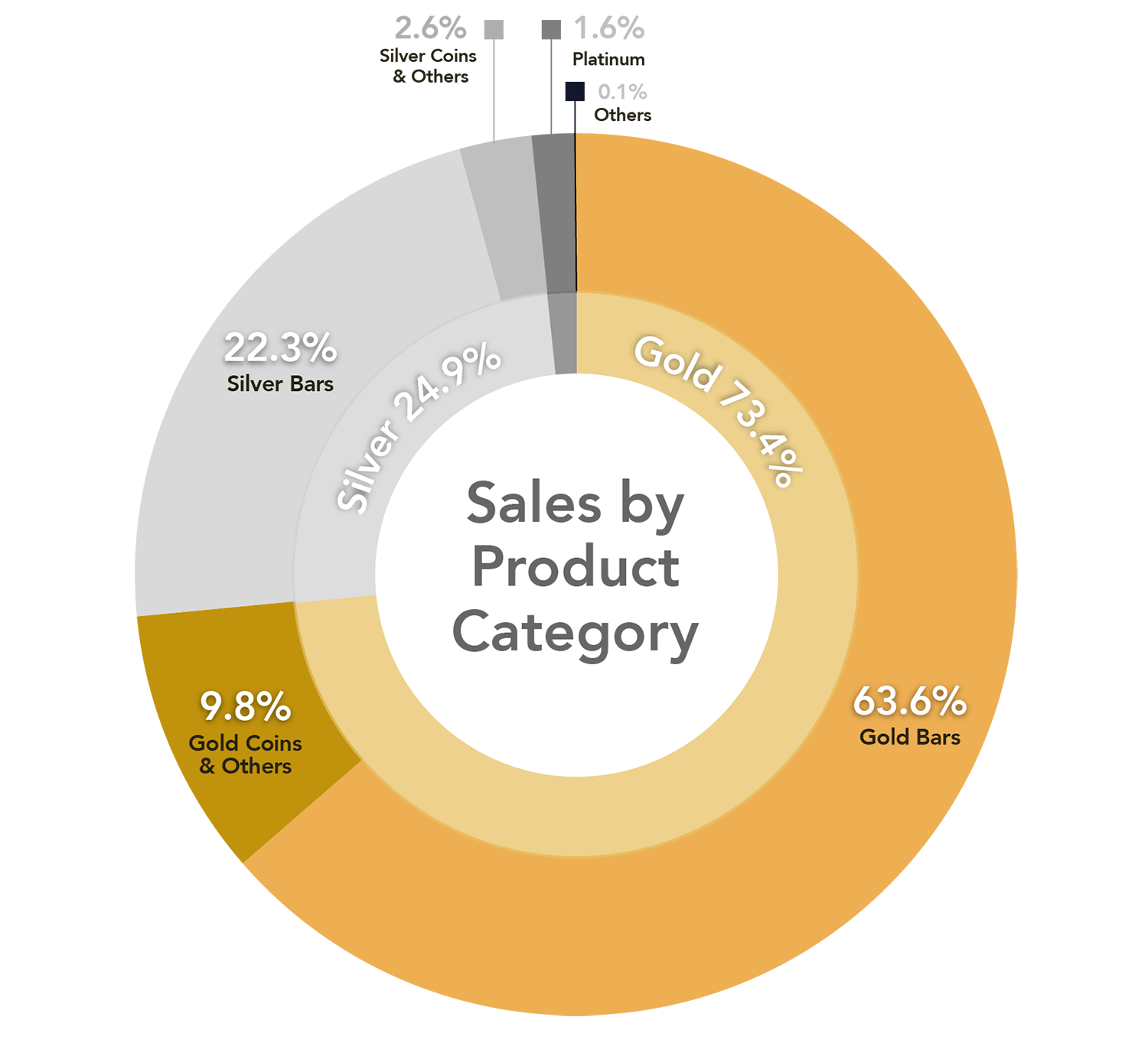

Sales per Product Category

- Gold: 73.4%

- Silver: 24.9%

- Platinum & Other: 1.7%

In FY 2024, 68% of sales were gold and 30% were silver. In FY 2025, there was a noticeable increase in gold sales.

Gold Products:

- Gold Bars: 86.6%

- Gold Coins: 13.1%

- Others (Numismatics, Jewellery, etc.): 0.3%

Within Gold Bars:

- 100g gold bars: 59.4%

- LBMA Good Delivery gold bars and 1kg gold bars: 27.8%

- Other sizes and products: 12.8%

Within Gold Coins:

- Canadian Gold Maple: 37.7%

- UK Gold Britannia: 21.2%

- Other products: 41.1%

Silver Products:

- Silver Bars: 89.4%

- Silver Coins and Rounds: 10.5%

- Others (Numismatics, etc.): 0.1%

Within Silver Bars:

- 1kg silver bars: 77.9%

- LBMA Good Delivery silver bars: 9.7%

- Other sizes: 12.4%

Within Silver Coins:

- Canadian Silver Maple: 16.7%

- UK Silver Britannia: 14.2%

- Other products: 69.1%

Customer Orders

- Buy Orders: 55,686 (up 44.6% from FY 2024)

- Average Order Size: SGD 13,873 (up 26.2% from FY 2024)

- Median Order Size: SGD 1,469 (up 46.7% from FY 2024)

As a global bullion dealer, BullionStar recorded sales to customers in 115 countries during FY 2025. Since our launch in 2012, we have served customers in 145 countries.

Website Traffic

- BullionStar.com Visits: 5,283,570 (up 42.7% from FY 2024), reflecting increased consumer interest in BullionStar and precious metals.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

Silver Enters 2026 in a State of Structural Breakdown

Silver Enters 2026 in a State of Structural Breakdown

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar

BullionStar 0 Comments

0 Comments